Retirement & Savings

As a Valdosta City Schools employee, your retirement benefits consist of two key components: 1) mandatory retirement plans (TRS or PSERS), 2) supplemental 403(b) retirement plan.

The Teachers Retirement System (TRS) and Public School Employees Retirement System (PSERS), available to employees, are established by the Georgia Legislature, with the governing boards determining plan design and employee contribution rates. Valdosta City Schools facilitates payroll deductions for your contributions and provides administrative support. Additionally, we offer a Supplemental 403(b) Retirement Plan to help you plan for the retirement you deserve.

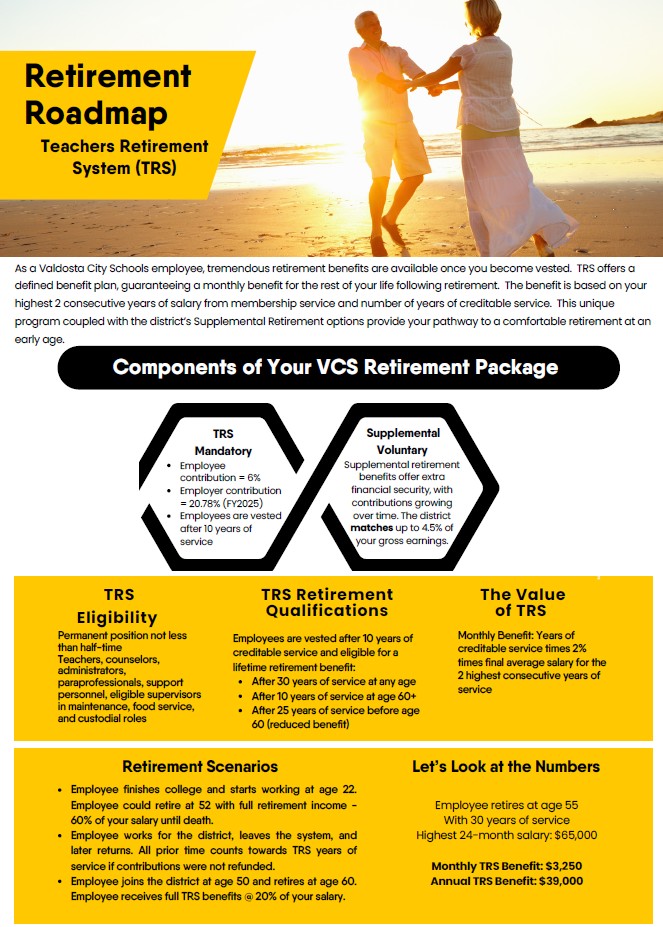

Teachers Retirement System (TRS)

The Teachers Retirement System (TRS) is a defined benefit plan that guarantees participants a fixed monthly retirement income. Employees eligible to participate include those working half-time or more in roles such as teachers, administrators, supervisors, clerks, teacher aides, secretaries, paraprofessionals, public school nurses, and managers or supervisors in the lunchroom, maintenance, warehouse, and transportation departments.

How Does It Work? All TRS employees contribute 6% of gross salary to TRS through monthly payroll deduction. In addition, Valdosta City Schools contributes 21.91% to each TRS employee’s retirement account monthly.

TRS members are vested with 10 years of creditable service and eligible to receive a monthly retirement benefit upon completion of the following:

- 10 years of creditable service and attainment of age 60.

- 30 years of creditable service, regardless of age.

- 25 years of service and before age 60, but with a permanently reduced benefit.

The amount you will receive at retirement is based on 2%, multiplied by your years of creditable service, multiplied by the average of your highest consecutive 24 months of pay.

Example:

2% x 30 years = 60%

Average of highest 24 consecutive months of pay = $70,000

60% x $ 70,000 = $ 42,000 / year

You may contact TRS at (800) 352-0650 to request a benefit estimate be mailed to you. You may also generate a benefit estimate online. The following documents are also available in the Resources section: TRS Member's Guide and TRS Retirement Checklist.

Click the flyer below to view a TRS Retirement Roadmap

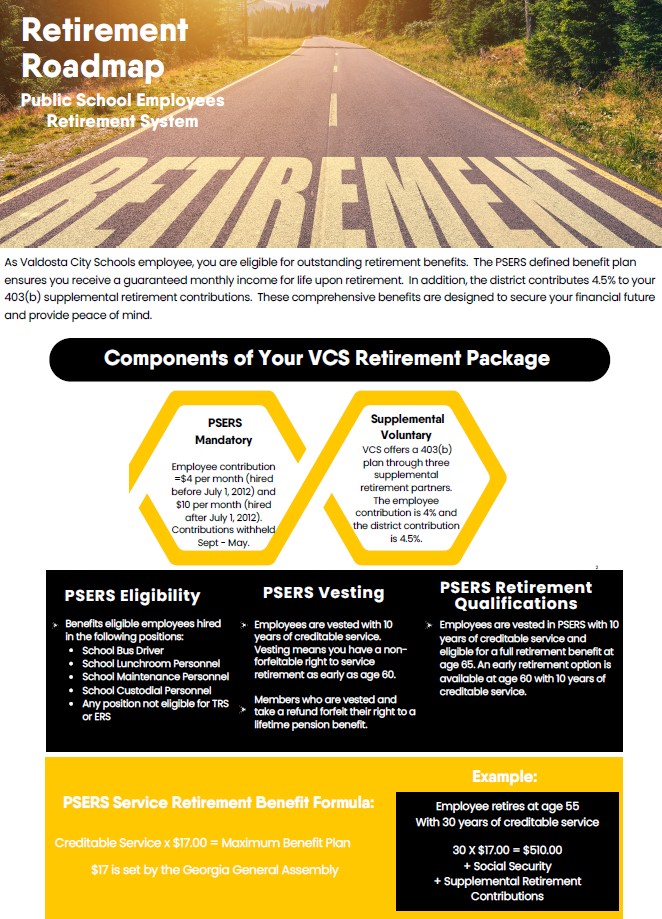

Public School Employees Retirement (PSERS)

The Public School Employees Retirement System (PSERS) is the retirement system for public school employees who are not eligible to participate in TRS. This is also a defined benefit plan, so participants are guaranteed a set monthly retirement income. Positions include non-supervisory roles in Maintenance, Food Service, Transportation, and Custodial functions.

How Does It Work? Participants in PSERS hired before 7/1/2012 contribute $4 monthly for a 9-month contribution period of September through May each year. Employees hired after 7/1/2012, without prior PSERS qualifying service, contribute $10 monthly for the 9-month period.

PSERS members are vested with 10 years of creditable service and eligible to receive a monthly retirement benefit at the:

- Completion of 10 years of creditable service and attainment of age 60, at a permanently reduced benefit.

- Completion of 10 years of creditable service and attainment of age 65 with full benefits.

The amount you receive in retirement is based on your years of creditable service multiplied by a set dollar amount. The current amount set by the Georgia General Assembly is $17.00.

For example, an employee with 30 years of creditable service would receive a monthly benefit based on the calculation of $17.00 X 30 years of service = $510.00 per month.

You may contact PSERS at (800) 805-4609 to request a benefit estimate be mailed to you. You may also generate a benefit estimate online by registering and logging into your PSERS account. You can also view the virtual PSERS Employee Handbook.

Click the flyer below to view a PSERS Retirement Roadmap

Supplemental Retirement Plans

Valdosta City Schools also offers a supplemental retirement plan benefit to help you prepare for the retirement you deserve.

In addition to the mandatory state-sponsored Teachers Retirement System (TRS) and Public School Employees Retirement System (PSERS) plans, Valdosta City Schools offers a 403(b) supplmental retirement plan to help employees enhance their financial future. We encourage all employees to explore these options. However, employees in a PSERS covered position are required to contribute at least 4% to the supplmental retirement plan.

What is a 403(b) plan?

A 403(b) plan is a tax-deferred retirement savings option available to employees of public schools and certain tax-exempt organizations. It allows you to contribute pre-tax dollars through convenient payroll deductions, helping you save for retirement. Since 403(b) plans are designed to encourage long-term savings, you typically can only withdraw funds when you reach age 59½, leave your job, or in cases of death or disability. Some plans may also allow withdrawals due to financial hardship. Be aware that withdrawing funds before age 59½ may result in federal restrictions and a 10% tax penalty. Employees aged 50 and older can make additional contributions up to $7,500 annually.

Why Contribute to a 403(b)? Participating in a supplemental plan offers several advantages:

- Lower Taxes Now: Contributions are made before taxes are deducted from your paycheck, meaning you pay taxes on a smaller income amount today, which reduces your current tax bill. For example, if your federal tax rate is 25% and you contribute $100 per month, your actual contribution cost is only $75 after tax savings.

- Tax-Deferred Growth: Your earnings and interest within the plans grow without being taxed until you make withdrawals. This tax deferral, combined with compounding interest, helps your savings grow faster compared to a taxable account, where earnings are taxed annually.

- Take Charge of Your Future: By contributing to a supplemental retirement plan, you're taking steps to secure your retirement. Other retirement income sources, Teachers Retirement System or Public School Employees Retirement System pensions don’t fully replace your final salary. It’s important to take control of your financial future to ensure you have enough savings for retirement.

Click here to see additional frequently asked supplemental retirement questions.

Contribution Details

TRS Covered Employees

- Participation in the 403(b) program is optional for employees in TRS-covered positions.

- Employees contribute 6% of their earnings to TRS.

- Valdosta City Schools contributes 20.78% of earnings to TRS.

- In addition, Valdosta City Schools will match up to 4.5% of your gross earnings to your supplemental retirement plan.

- You are vested 100% and eligible to receive employer contributions to your supplemental retirement after three years of service with Valdosta City Schools.

PSERS Covered Employees

- Participation in the 403(b) program is required for employees in a PSERS covered position.

- PSERS participants hired before 7/1/2012 contribute $4 monthly from September to May. Those hired after 7/1/2012 without prior qualifying service contribute $10 monthly for the same period.

- The 403(b) supplemental retirement program requires a minimum employee contribution of 4% of gross pay.

- Valdosta City Schools contributes an additional 4.5% of gross pay to the 403(b) program.

- Employees are 100% vested in employer contributions from their hire date.

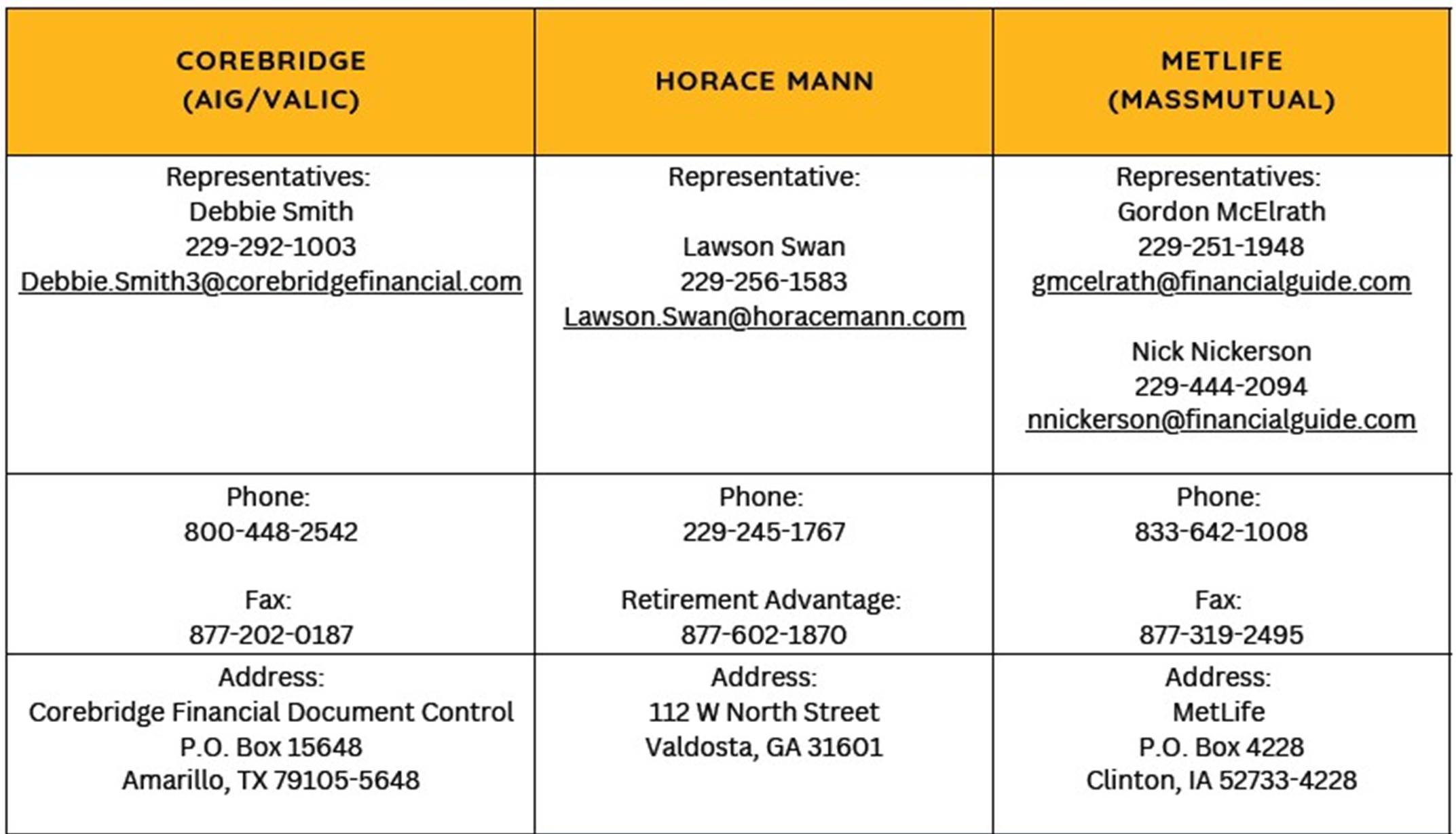

Vendor Contact Information

Valdosta City Schools has partnered with three supplemental retirement vendors for your 403(b) plan. Please contact one of the following vendors to participate.

Planning to Retire?

To learn more about your medical plan options in retirement, please review the State Health Benefit Plan Planning to Retire webpage.

TRS Covered Employees: If you are within two years of retirement, whether due to age or years of creditable service, TRS can provide personalized benefit projections. TRS encourages all members nearing retirement to log in to their TRS online account and schedule a one-on-one counseling session. These sessions allow you to bring a guest, receive tailored benefit information, and ask any questions about your retirement options.

PSERS Covered Employees: For an overview of key retirement details, download the PSERS Benefits at a Glance document.

If you have additional questions, please email the Benefits Service Center at help@vcsbenefits.org.