Permanent Life Insurance with Long Term Care

Valdosta City Schools offers Permanent Life Insurance with Long Term Care coverage through Trustmark. These portable Universal Life insurance plans are designed to meet diverse employee needs and provide lifelong peace of mind. Along with life insurance protection, the plans include valuable long-term care benefits, addressing a growing need in today’s population. Each year, over 8.5 million individuals rely on support for long-term care services.

You can choose between two Universal Life insurance options: Universal Life with Long Term Care and Universal LifeEvents with Long Term Care. Both options offer convenient payroll deduction and the flexibility to adjust the death benefit, premiums, and cash value as your needs change. They also provide access to the cash value, allowing you to surrender coverage or use accumulated cash value to pay premiums. Additional features include an accelerated death benefit, which allows you to receive 75% of the death benefit if your life expectancy is 24 months or less, and a maturity date at age 100. Both plans include a long-term care benefit that provides 4% of your death benefit per month for up to 25 months, covering home care, assisted living, adult day care, and nursing home care.

Option 1: Universal Life Insurance with Long Term Care

This plan provides consistent financial support with a death benefit that remains unchanged as long as premiums are paid. Although the premiums for this option are higher, it offers several advantages:

- The death benefit does not decrease with age.

- It accumulates greater cash value over time.

By combining long-term care and death benefits, this plan ensures coverage for both extended care needs and final expenses.

Option 2: Universal LifeEvents Insurance with Long Term Care

This option focuses on maximizing financial support during your working years, when life insurance needs are often greatest. It provides a higher death benefit during that time. At age 70, the death benefit reduces to half of the greater of age 70 or the 15th policy anniversary.

With lower premiums compared to Option 1, this plan offers an affordable way to balance life insurance protection and long-term care coverage.

| Item | 1) Universal Life w/ Long Term Care | 2) Universal LifeEvents w/ Long Term Care |

|---|---|---|

|

Level Life Insurance Benefit

Regardless of Age |

Yes Death benefit does not reduce |

No Death benefit reduces to 1/3 of the original face amount at age 70 or 15 years - whichever is later |

|

Cash Value

|

Higher cash value than Option 2 | Lower cash value than Option 1 |

|

Long Term Care Benefit

|

4% of face amount for up to 25 months |

4% of face amount for up to 25 months |

|

Premiums

|

Higher than Option 2 |

Lower than Option 1 |

Coverage Options

Trustmark’s portable Universal Life with Long Term Care provides coverage for both employees and their spouses in increments of $10,000, with a maximum of $300,000. Child coverage is available up to $35,000, depending on the child's age. Employees may choose either Universal Life or Universal LifeEvents, but not both. Spouse coverage is available without requiring employee coverage.

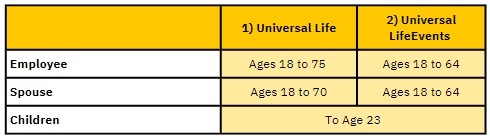

Issue Age Eligibility

Permanent Universal Life vs Traditional Whole Life

- Trustmark's permanent universal life options offer greater flexibility compared to traditional whole life insurance.

- With Trustmark’s policies, you can adjust both your premiums and death benefit at any time, while traditional whole life requires fixed premiums and full payment to keep the policy active.

- Premiums for traditional whole life are typically higher than those for Trustmark’s permanent universal life options.

- While traditional whole life offers higher guaranteed cash values, Trustmark’s permanent universal life options may have lower cash value guarantees.

- Trustmark’s permanent universal life options’ lower premiums allow you to purchase a higher death benefit for the same premium amount compared to traditional whole life.